ParentPay Donations makes fundraising easier than ever. Donations streamlines your fundraising efforts, enabling payers to donate online in an instant – with or without a ParentPay account.

Best of all, setting up a Donations page is quick and easy. Add your school’s logo and branding, set a fundraising target, and share your page within minutes. Because friction-free fundraising is the future.

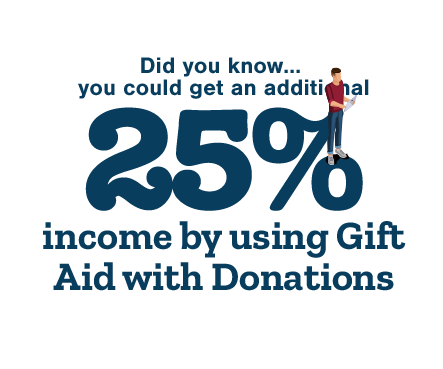

Collect donations online with or without Gift Aid and minimise the amount of cash held in school. Save your school office valuable time with automated cash administration.

Accept donations from anyone – with or without a ParentPay account. Collect donations from parents, extended family, and friends to maximise your fundraising efforts, spread your story, and get more support.

Click the links below for more related content and articles from ParentPay