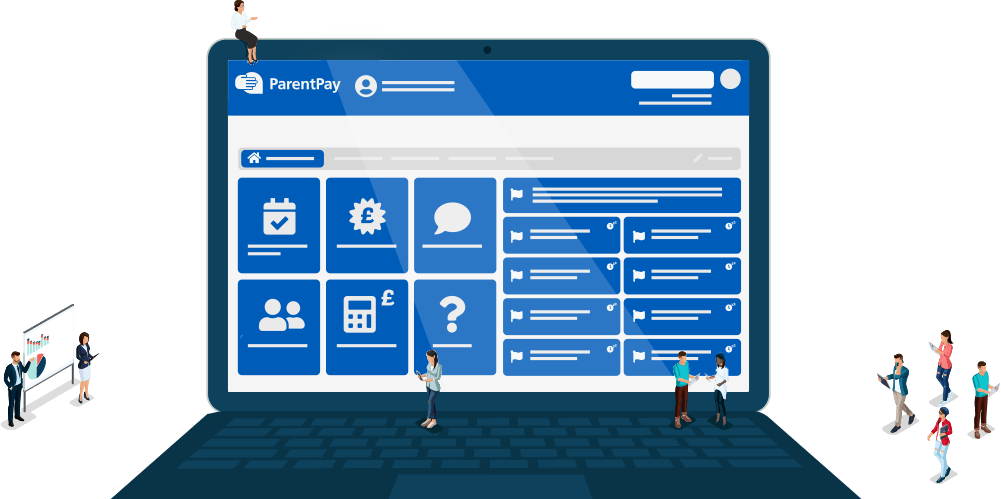

Collect & manage payments for meals, clubs, trips and more - all from one place.

Transform your money management with the most secure and trusted cashless payment solution.

Our school payment services Enquire today

Industry-leading financial reporting for UK schools - no matter how big or small

A totally customisable app giving real insight for all schools, from Multi-Academy Trusts to local nurseries.

Special offer:

Switch to premium parental engagement today and pay later.

Experience the power of Schoolcomms and communicate with parents without paying a thing until your current contract ends. Terms and conditions apply.

Find out more

Introducing ParentPay Clubs

Club management, without the hassle. ParentPay Clubs takes away the paperwork and makes running breakfast and after-school clubs easier than ever, giving your staff more time to offer quality wraparound care.

Find out more11k schools

trust ParentPay to manage their online payments

4 million

parents use ParentPay to make secure payments

47 seconds

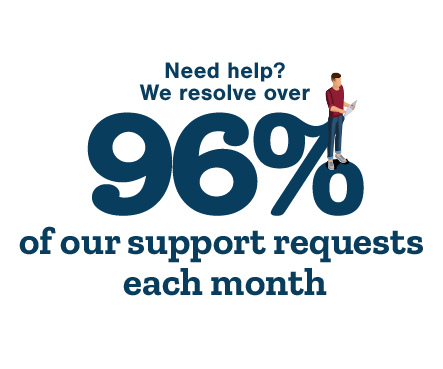

is the average wait time for calls to our support team

Download the Ultimate Cashless Payments Guide

Download our end-to-end guide for adopting or switching your cashless solution.

Whether you’d like us to answer your questions, provide your school with a quote, or give a free demonstration of our system, we’re here to help. And, if it’s easier, we can come to you. Simply arrange to see us in person and we’ll show you how it all works.

We can help you with much more than managing payments.

Parental Engagement is key to raising achievement in schools. That’s why we’ve made it simple with our all-in-one parent app for schools.

Meal pre-orders and cashless catering across multiple sites are handled seamlessly with Meal Selection – designed specifically for the education sector.

We can help you with much more than managing payments.